Empowering community associations by leveraging various technologies that overcome barriers common to lending, such as cost-to-serve, risk, and efficiency.

About Us

About Us

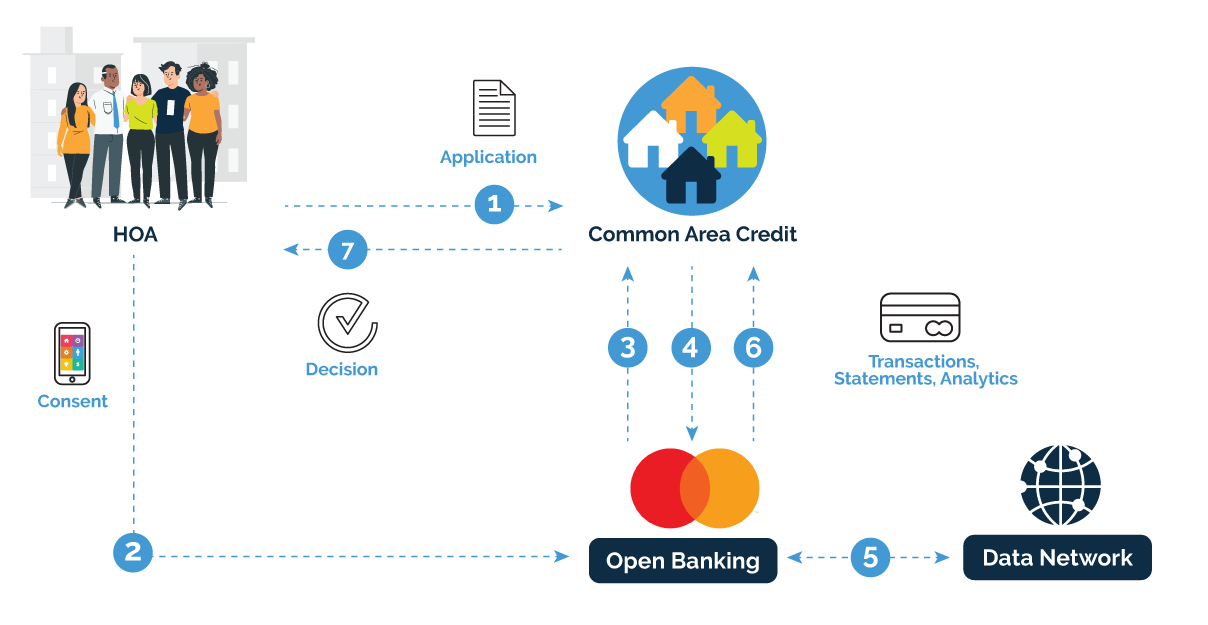

CommonArea Credit Inc. (“CommonArea”) is a nonbank lender to homeowners associations (HOAs). The Company empowers HOAs by offering fast, simple access to debt financing for essential repairs, renovations, and community improvements. CommonArea combines cross-platform data sharing through a robust API stack with AI-powered underwriting, resulting in a seamless consumer experience.

We Help People

Because our technology is more efficient, it empowers us to extend our reach, enabling us to help more people by facilitating quick and effective loan decisions. The magic we provide is in “quickly” deciding what can (and can’t) be done to help. The faster we make a credit decision, the more homeowner communities and individual people we can help.

From Our Founder

From Our Founder

It’s like this… Every bank has an HOA loan department. They ALL want you to:

-

- Schedule a call (or come into their office) and speak with a manager, then

- Transfer your deposit and savings accounts over… So they can lend you your own money back!

Whenever they get around to funding your loan, they syndicate it to other investors. This is what banks do. They are in the business of underwriting and syndicating loans. This is NOT what we do.

We offer community associations fast, simple access to debt financing. Due to the structure and duration of our liabilities and our cost of capital, we have a competitive advantage in providing these loans over banks. Don’t get me wrong; banks do many things that we don’t do. They provide cash management, savings and deposit accounts, etc. On the other hand, we are a natural and much steadier home for the liability: for the loan.

William Baker

Relationship Banking vs Transactional Borrowing

Relationship Banking

“No matter how much they talk about relationship banking, we never met anyone who lent us money.”

Mary Jane Hunter, Property Manager

Transactional Borrowing

“Lending and borrowing all happen on the Internet and is driven by credit score algorithms because that’s how the transactional relationship works.”

Marcus Johnson, PhD

How We Do It