Empowering Community Associations with:

-

Best-in-Class Technological and Procedural Security Safeguards

-

Secure, Rapid Loan Origination and Payments

-

Fair Credit Reporting Act-Compliant Reporting

Applying is fast, easy, and 100% online!

Request For Loan Proposal

- Apply in minutes

- Register to receive your association’s “Payment at Risk and Scoring Report”

- Get a Summary of Your Rights Under the Fair Credit Reporting Act

Submit Loan Application

- All items requested in the Loan Application Checklist must be submitted before the Lender fully considers the application.

Loan Approval & Funding

- The Lender requires an attorney’s opinion letter in form and content satisfactory to the Lender. To avoid delays or problems in securing the association’s attorney’s opinion letter, we recommend the association engage legal counsel early in the borrowing process.

Applying is fast, easy, and 100% online!

Request For Loan Proposal

- Apply in minutes

- Register to receive your association’s “Payment at Risk and Scoring Report”

- Get a Summary of Your Rights Under the Fair Credit Reporting Act

Submit Loan Application

- All items requested in the Loan Application Checklist must be submitted before the Lender fully considers the application.

Loan Approval & Funding

- The Lender requires an attorney’s opinion letter in form and content satisfactory to the Lender. To avoid delays or problems in securing the association’s attorney’s opinion letter, we recommend the association engage legal counsel early in the borrowing process.

See How Your HOA Collection History Affects Lender Credit Decisioning

After submitting a Request For Loan Proposal, a communication is automatically generated and sent to the HOA for permission to use their data.

- Data is pulled directly from the bank. No loan officer handling documents means a zero chance of fraud.

- Data is intelligently analyzed and summarized.

- Reports are generated in as little as 30 seconds and delivered as a PDF.

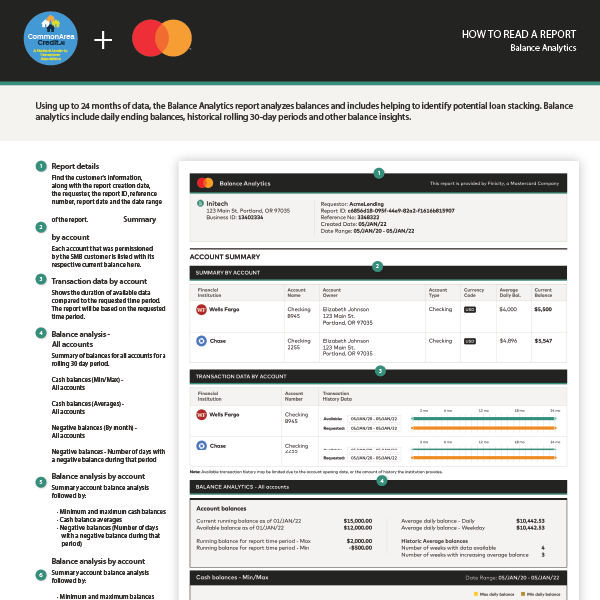

Balance Analytics

Balance Analytics evaluates an association’s loan applicant’s bank account balances to help identify risks for a lender approving a loan. An aggregate view of all the accounts the customer has permissioned access to view is provided in a report. This API is compliant with the Fair Credit Reporting Act.

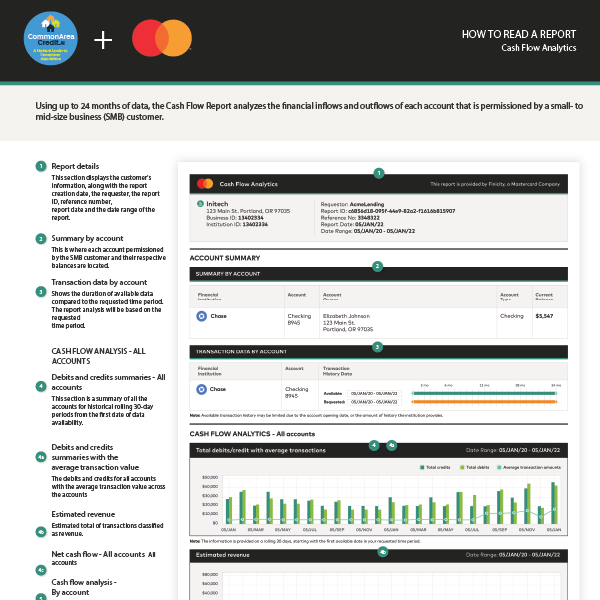

Cash-Flow Analytics

Cash Flow Analytics evaluates an association’s loan applicant’s cash flows to help identify risks and give insights to a lender approving a loan. A summary of all the accounts the customer has permissioned access to view is provided in a report. This API is compliant with the Fair Credit Reporting Act.

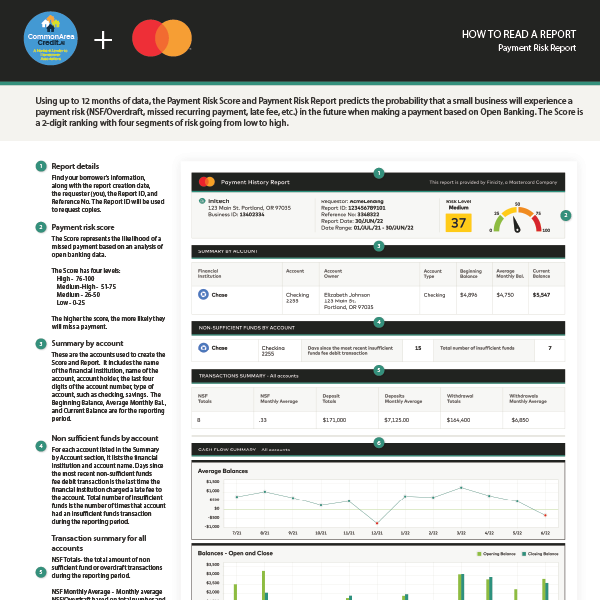

Payment Risk & Scoring

Using up to 12 months of data, the Payment Risk Score and Payment Risk Report predicts the probability that an association will experience a payment risk (NSF/Overdraft, missed recurring payment, late fee, etc.). The Score is a 2-digit ranking with four risk segments going from low to high.

What does CommonAreaCredit.AI do differently from a bank?

We have digitally transformed the time-consuming loan origination workflow, accelerating credit decisioning from weeks to minutes, creating optimal efficiency for borrowers and lending advisors: no more nine-week loan approvals and stacks of paperwork. Key differentiators include 1) nonbank lending, 2) consumer-permissioned data, and 3) registered consumer reporting agency (CRA).

We’re a Nonbank Lender

A nonbank lender is a financial institution that lends money but does not offer deposit, checking or savings services.

Consumer-Permissioned Data

Consumer-permissioned data is created by consumer financial activity and authorized or permissioned by the consumer for use in various applications or financial services.

Registered Consumer Reporting Agency

We give consumers more control, access, and insight over their financial data, including dispute and disclosure processes. FREE! See a summary of Your Right Under the FCRA: https://www.finicity.com/a-summary-of-your-rights-under-the-fair-credit-reporting-act/

Case Studies

- ABC Loan Provider: Reported a 15% cost reduction and a 20% faster loan origination process.

- XYZ Homeowners Association: Found the transparency beneficial in gaining trust among community members.

Relationship Banking vs. Transactional Borrowing

Relationship Banking

“No matter how much they talk about relationship banking, we never met anyone who lent us money.”

Mary Jane Hunter, Property Manager

Transactional Borrowing

“Lending and borrowing all happen on the Internet and is driven by credit score algorithms because that’s how the transactional relationship works.”

Marcus Johnson, PhD